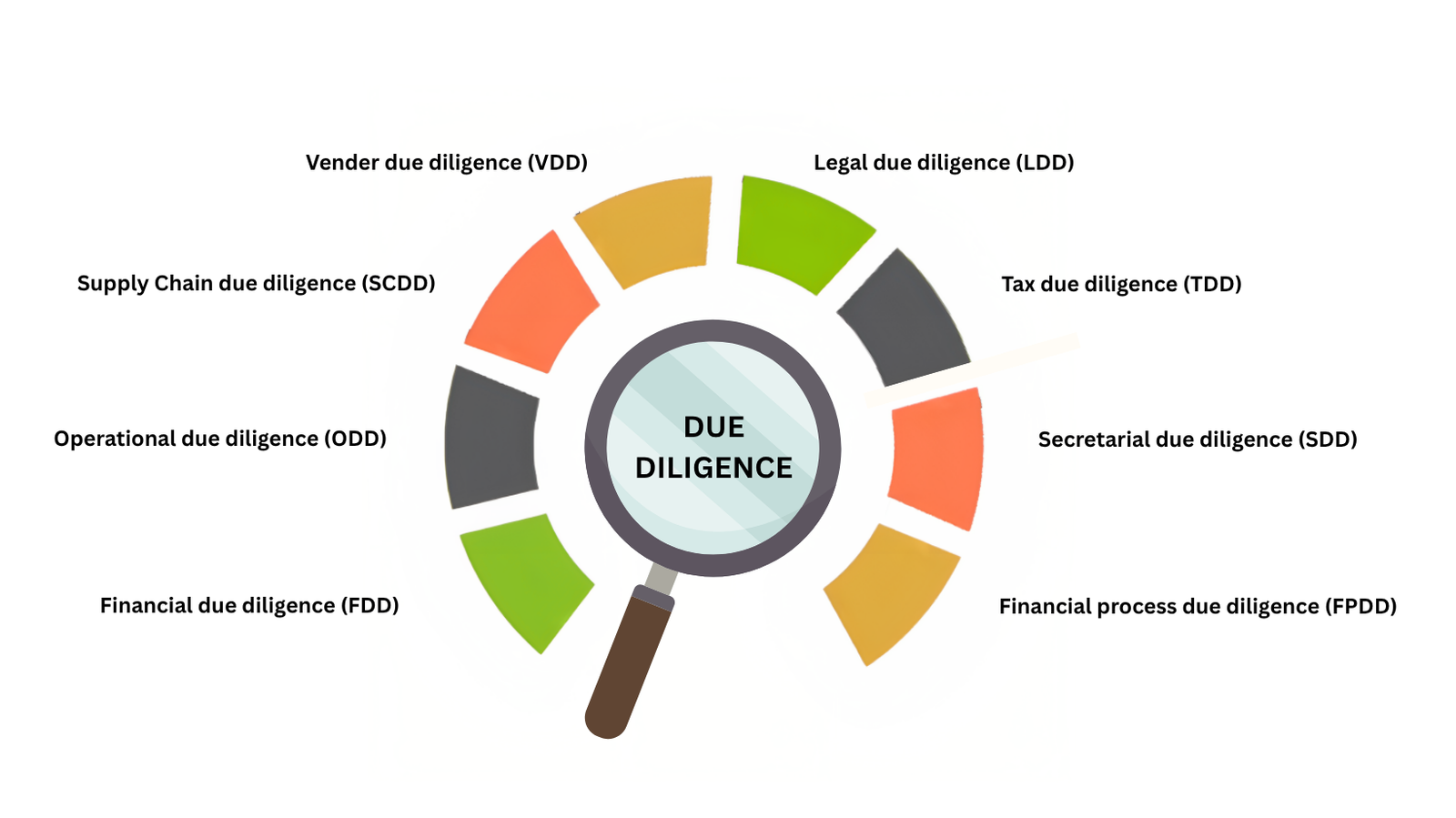

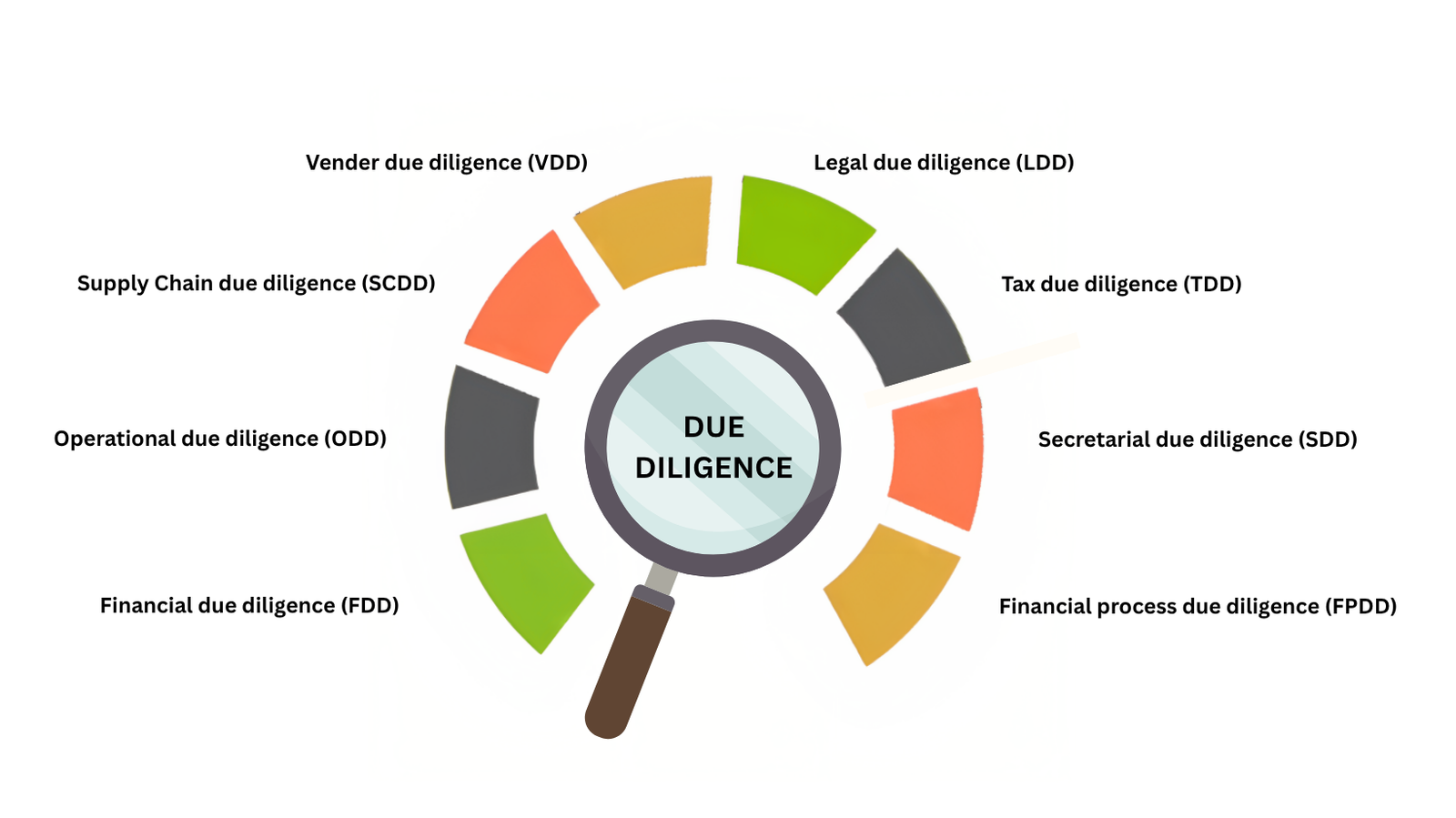

Due Diligence

The Due Diligence team at DVA Strategies LLP brings rich expertise, by combining professionals who have led private equity and corporate deals in the Indian M&A space with those who have supported US based transactions from India. This diverse experience enables us to deliver exceptional client service and handle majority of diligence work from India, ensuring efficiency and quality. We perform a comprehensive investigation of the company, its operations and highlight all the associated risks before you do a significant transaction, such as a merger, acquisition, or investment.

Transactions Services

- Buy-Side diligence

- Sell-Side diligence

- Vendor assist projects

- Review of Closing Accounts

Financial Due Diligence (FDD)

- Quality of Earnings (QoE)

- Defining net-debt or indebtedness

- Analysis of revenue and key business drivers

- Carve-outs and estimating stand-alone costs

- Forecast and model sensitivity analysis

- Data Analytics tools like Power Query, Power BI, etc.

- Sector specific analysis like waterfall, retention analysis, etc.

- Defining the working capital target and analysing historical working capital trends

Operational Due Diligence (ODD) - Operational DD examines a company's internal processes, management effectiveness, financial stability, and overall operational risks. It helps investors and stakeholders understand potential inefficiencies, compliance gaps, and areas for improvement before making business decisions.

- Efficiency Assessment – Identify areas of improvement

- Cost Savings – Uncover potential savings

- Processes Analysis – Assess daily operations and workflows.

- Employee Review – Check contracts, benefits & HR policies

- Technology Check – Assess infrastructure and operational systems

What is it that concerns you? Vendor reliability, supply chain integrity or operational efficiency – we have you covered.

Supply Chain Due Diligence (SCDD) - SCDD focuses on assessing a company's supply chain to identify vulnerabilities, risks, and compliance with regulatory standards. It includes evaluating suppliers, logistics, procurement processes, and sustainability practices to ensure resilience and efficiency.

- Supply Chain Mapping

- Supplier Reviews

- Procurement Process

- Risk Assessment

- Traceability Process Review

- Policy Review

- Compliance Review

- Environment & Sustainability Practices

Vendor Due Diligence (VDD) - Vendor DD involves a thorough assessment of third-party vendors to mitigate risks related to financial stability and security. It ensures that vendors align with the company's standards, reducing potential disruptions and liabilities.

- Basic Company Information

- Management & Key Personnel

- Business Structure

- Financial Statements

- Creditworthiness

- Compliance with Laws & Regulations

- Licenses & Permits

- Operational Capacity

- Information Security

- Business Continuity & Disaster Recovery

- Reputation Checks

- Ethical Standards

Legal Due Diligence (LDD) - Legal DD involves a comprehensive review of the legal aspects of a business to identify risks and ensure compliance. This includes evaluating contracts, regulatory adherence, litigation history, licenses, and intellectual property rights—primarily within the Indian legal framework.

- Regulatory Compliance – Verify industry regulation compliance (limited to Indian Scenarios)

- Litigation History – Investigate past legal challenges (limited to Indian Scenarios)

- License Validation – Ensure the company has all the necessary licenses (limited to Indian Scenarios)

- Intellectual Property – Audit patents, copyrights, and trademarks (limited to Indian Scenarios)

- Contracts – Examine customer, supplier, and partnership contracts

Tax Due Diligence (TDD) limited to Indian markets

- Financial Statements Review

- Methods of accounting

- Income tax returns

- Review Company's tax Audits

- GST Returns or Records

Secretarial Due Diligence (SDD) limited to Indian markets - Reviewing of key documents and processes to ensure a company's compliance with company law and regulatory requirements, including charter documents, regulatory filings, and meeting minutes.

- Regulatory Filings

- Board Minutes of the Meeting

- Share Allotment Filings

- Statutory Registers

- Compliance with Laws

- Penal Proceedings

Financial Process Due Diligence (FPDD)

- Developing Current Operating Model

- Understanding current process attributes

- Capturing desired process requirements

- Gap identification

- Potential Solutions