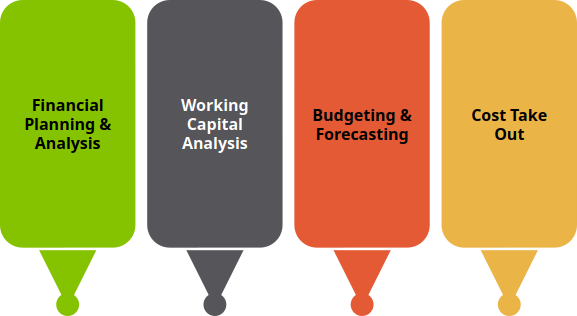

Financial Planning

Financial Planning & Analysis – FP&A is conducted to provide insights and recommendations to help organizations make informed decisions about their financial future and optimize their business strategies.

- Planning and Budgeting - Developing financial plans and budgets that align with the company's strategic goals.

- Forecasting - Predicting future financial performance and outcomes, including revenue, expenses, and cash flow.

- Analysis - Analysing financial data to identify trends, opportunities, and potential risks.

- Management Reporting - Preparing financial reports and dashboards to communicate financial performance to stakeholders.

Working Capital Analysis – Assessment of a company's short-term liquidity and financial health by examining the current assets and current liabilities.

- Liquidity Assessment

- Inventory

- Account Receivables

- Account Payables

- Unlocking the funds locked in working capital

Cost Take Out – Identify and eliminate unnecessary expenses to improve financial performance and profitability, through strategic cost reduction initiatives. Strategic and long-term approach that aims to create sustainable cost savings and improve overall business performance.

- Reduce Supply Costs

- Diminish Production Costs

- Cut costs associated with financial accounts

- Modernize your marketing approach

- Minimize time wasting and drive efficiency

- Cut costs with virtual technology

- Make the most of your physical workspaces

- Narrow your business focus

- Maximize your employees' skill

- Seek expert cost-cutting advice

Standalone Cost Model - Standalone Cost Model focuses on costs of running a business unit independently after a separation, specifically on direct expenses and excluding shared costs, which is crucial for accurate financial reporting and strategic decision-making.